AIIB

One of the key highlights of AIIB's collaboration has been the facilitation of $360 million in concessional financing to support 11 private sector companies.

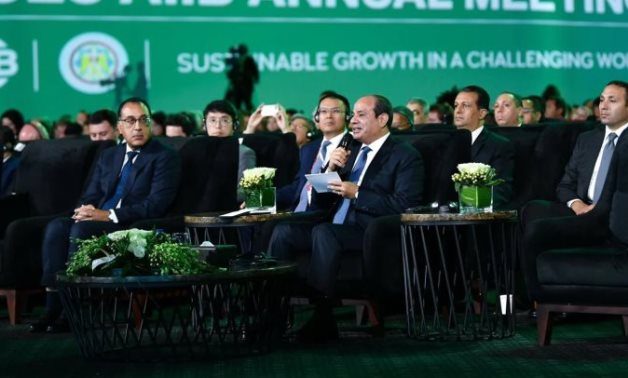

President Abdel Fattah el-Sisi called on the Asian Infrastructure Bank (AIIB) to play a greater role in low-cost financing to support economies amid global challenges.

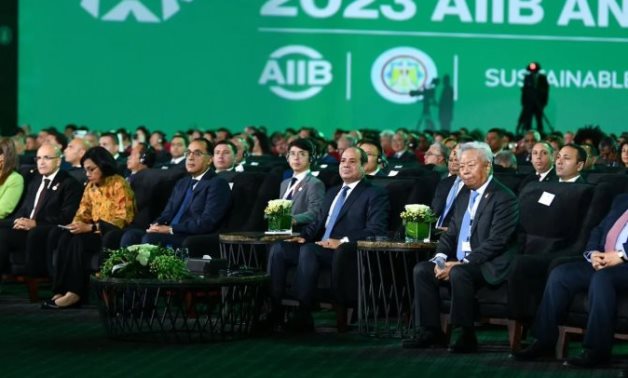

The event in Sharm El Sheikh showcased the commitment of global leaders to collectively address global development challenges.

The selection of Sharm El Sheikh as the venue for the AIIB's annual meetings underscores Egypt's growing prominence on the global economic stage.

Egypt's hosting of this globally significant event sends a resounding message to the world.

Egypt's hosting of this globally significant event sends a resounding message to the world.

During the meetings, Egyptian Minister of Finance Mohamed Maait said that Egypt's hosting of the conference "reflects the country's role regionally and internationally."

The 8th annual AIIB meetings kicked off in Sharm el-Sheikh city Monday under the auspices of Egypt’s President Abdel Fattah El Sisi.

Maait explained that Egypt is working closely with the AIIB, a multilateral global bank, to establish cross-border developmental partnerships, primarily led by the private sector.

The AIIB’s annual meetings will also act as an international forum for shedding light on Egypt’s role in connecting the continents of Africa, Asia, and Europe together, an official statement by the ministry wrote

As a founding member of the AIIB, Egypt aims to fortify connections between Africa and Asia and realize its sustainable development goals with the overall goal of improving the livelihoods of African citizens, Maait stated

Maait elaborated Thursday that Egypt is one of the founding countries of the bank, and the largest shareholder from the African continent.

These remarks were made by Mashat during her participation on the second day of the 7th round of Banks' Chief Executive Officers (CEOs) under the title of "How the Egyptian Economy Survived the Trap of International Recession".

The World Bank and the Asian Infrastructure Investment Bank have agreed to provide in total $720 million for the Development Policy Financing (DPF) framework, with $360 million from each institution.

The World Bank: “We are keen on continuous dialogue with our partners, and the reforms established have helped the Egyptian economy persist despite challenges.”

This twin-track approach integrates green growth in Egypt’s national development plans through national and international-level actions, Al-Mashat added.

Berglöf clarified Tuesday that his bank support the diversification of energy mix towards renewables in Egypt which lead to 11 projects in Benban solar Part and rural sanitation project.

The minister referred to Egypt’s growth rate despite the recession caused by COVID-19 pandemic, referring to the expectations for Egypt to hit 5 percent growth rate during 2021.

The agreement was signed in the Red Sea resort city of Sharm el Sheikh on December 9, 2018. It was approved by the House of Representatives on April 14, 2019.

The Asian Infrastructure Investment Bank (AIIB) is currently seeking to establish more investment projects in Egypt.

Most Read