FinTech

Additionally, the committee approved the creation of V.Lens, a company specializing in electronic identification, verification, and authentication services.

“Robo-advisors for Investment” framework has been set by the Financial Regulatory Authority (FRA), regulating the new frontier for FinTech/asset management in Egypt

The “Women for Women in FinTech” initiative falls under the “Accelerate'ha" initiative, launched back in 2021 by the CBE to accelerate the development of innovative FinTech solutions for women-led businesses

The Central Bank of Egypt (CBE) aims to strengthen monetary policy efficiency and the Egyptian pound’s competitiveness

The primary objective of this resolution is to ensure the financial stability of these companies and their ability to deliver efficient services

This investigation was launched in response to claims made earlier this month regarding a cyberattack on Fawry's systems by the notorious ransomware attacker known as LockBit

Prime Minister Mostafa Madbouly expressed his belief that financial technologies and sustainability are key drivers of change as “we live in a rapidly evolving digital age,” during a speech on Tuesday

Within the authority’s framework and efforts to enhance regulatory capabilities, and safeguard customer rights, FRA Chairman Mohamed Farid issued Circular No. 4 of 2023

Sarhan emphasized the company's extensive expertise in the field of financial technology and stated that it is studying the license’s requirements with its local and international partners

With the new licensing regulations, digital banks will be required to keep a minimum issued and paid-up capital of LE 2 billion ($65 million)

Regional funding reached its lowest recording during Q2 2023, contracting to $619 million compared to $1.26 million in Q1 2023

The digital payments platform for small businesses, axis, launched its services in partnership with Visa. This is after the platform obtained a license from the Central Bank of Egypt (CBE) for its open-loop mobile wallet.

This came during Vigliotti’s visit to Money fellows, as a part of the EIB's initiative to explore investment opportunities in Egypt, supporting sustainable financial inclusion in the country.

Exits MENA is now authorized to offer listing and public offering services to its clients on the Egyptian Stock Exchange (EGX) and the SME platform, Nile Stock Exchange (NILEX) under law no. 95 of 1992.

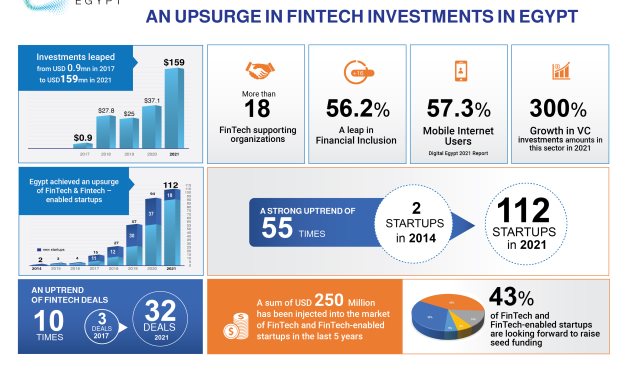

Additionally, the report exhibited the extensive progress in the FinTech industry, starting with only 2 startups in 2014 to a total of 112 Egyptian FinTech and FinTech-enabled startups by 2021, with a strong uptrend of 55 times, and positioning Egypt among the top 4 active African countries in the FinTech Industry.

The report sheds light on the local FinTech & FinTech-enabled startups and entrepreneurs; in addition to FinTech Ecosystem stakeholders such as incubators, accelerators, investors, and supporting organizations.

This partnership focuses on enhancing the entrepreneurship environment in Egypt, pushing towards the 17 United Nations Sustainable Development Goals (SDGs).

<i> Visa connects 3 billion accounts, 46 million merchants and 16,000 financial institutions, empowering clients, merchants, SMEs, and partners with safe and innovative payment technologies help shape the future pf payments </i>

Fintech in Egypt still relies heavily on payments.

Egypt Today conducted an interview with GEN’s founder and president, Jonathan Ortmans.