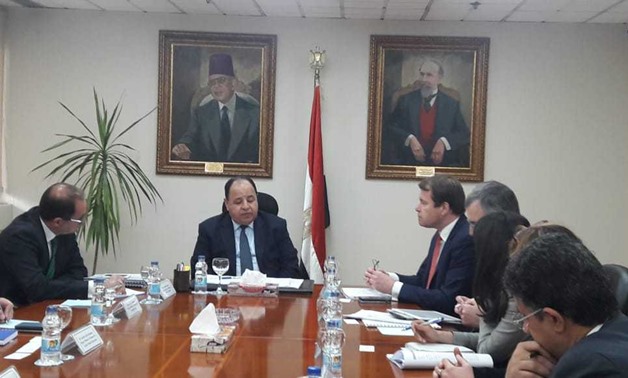

Minister of Finance Mohamed Ma’it during the meeting- Press photo

CAIRO – 14 May 2020: The minister of finance reviewed the most prominent details of the amendments of some provisions of the income tax law, stressing that they reflect tax justice in an incremental manner, improve tax brackets for the benefit of the largest part of society and serves the middle class in a manner that contributes to raising the citizens' standard of living.

Minister Mohamed Ma’it said that after the issuance of a law amending some provisions of the income tax, the new tax system for salaries and wages will be implemented from the beginning of July 2020.

He said that it applies to the income derived from commercial and industrial activity, the income of non-commercial professions, or the income from real estate wealth starting from the tax period that ends after the date of the law’s entry into force.

The minister stressed that in light of the new amendments the income tax on individuals will be progressive, fair, and achieve tax savings for the lower, middle and upper middle classes. Also, it addresses the distortions of the current system based on tax deduction.

Ma'it added that it includes increasing the tax exemption limit by 60 percent, as the basic exemption limit for each financier has been raised from LE 8,000 to LE 15,000, in addition to increasing the personal exemption limit for salaries from LE 7,000 to LE 9,000, and therefore the annual income for those with salaries up to LE 24,000 are tax free.

“According to these amendments, a new social segment has been created for low income citizens, whose annual net income ranges from LE 15,000 to 30,000, other than the limit for personal exemption, so that the tax on them is 2.5 percent. From more than LE 30,000 to LE 45,000, the tax will be 10 percent instead of 15 percent, and from more than LE 45,000 to LE 60,000, the tax will be 15 percent instead of 20 percent."

"Taxes on the income range, exceeding LE 60,000 to LE 200,000 will be 20 percent instead of 22.5 percent, and taxes on th range exceeding LE200,000 to LE 400,000 will be 22.5 percent, and a new segment at a price of 25 percent for people with higher incomes will be created."

Comments

Leave a Comment