Some of Europe's biggest banks are being challenged by environmental groups to sever all lending to utilities which they say are still developing new coal-fired power plants. PHOTO: AP

LONDON – 6 December 2019: Some of Europe’s biggest banks are being challenged by environmental groups to sever all lending to utilities which they say are still developing new coal-fired power plants.

The call comes as some 190 countries meet in Madrid to assess progress on the 2015 Paris Climate Agreement, which demands a virtual end to coal power by 2050.

A United Nations report last year said almost all coal-fired power plants would need to close by the middle of this century to curb a rise in global temperatures to 1.5 degrees Celsius, in line with the level scientists say is needed to stave off the worst effects of climate change.

“Some banks have pledged to not directly finance new coal plants but they are providing general finance to companies which are building new plants,” Katrin Ganswindt of German environmental pressure group Urgewald told Reuters.

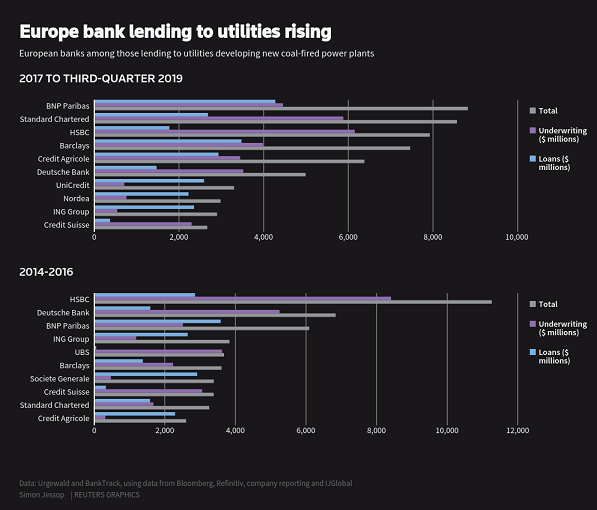

Urgewald and BankTrack, an NGO focused on banks and the activities they finance, said an analysis of the 10 most active European lenders to companies which are still planning or developing new coal plants indicated total debt funding had risen to $56 billion between 2017 and the end of September 2019.

This compared with a calculation of $48 billion for the period 2014 to 2016, the pressure groups said in a report provided to Reuters on Thursday.

The 10 banks were Barclays, BNP Paribas, Credit Agricole, Credit Suisse, Deutsche Bank, HSBC, ING, Nordea, Standard Chartered and UniCredit.

Most of those named said the report did not reflect their efforts to stop funding coal plant development or a commitment to lowering carbon emissions. Credit Suisse declined to comment.

Britain’s Barclays said it no longer provides project finance to any new coal-fired power plants or expansions of existing ones and disagreed with some of the data:

“The report misrepresents and does not differentiate cases where Barclays finances a subsidiary investing in renewable energy, when its parent company may have other subsidiaries involved in coal, which have no relationship with Barclays.”

Comments

Leave a Comment