CAIRO - 27 January 2018: The Egyptian Banking Institute (EBI) launched on January 24 an initiative to discuss digital financial services (DFS) eco-systems locally and globally. The initiative came in collaboration with the International Finance Corporation (IFC), a member of the World Bank Group, and banking sector representatives in Egypt.

The initiative discussed “how banks can make use of new technologies that promote cashless transactions, tackle cyber risk management and digitize their banks and … services,” according to the IFC. This comes in a unified effort between the two parties involved to increase financial inclusion in Egypt and expand banking services in the country, an effort that the Central Bank of Egypt (CBE) has been working on recently via loans, especially for women.

CBE’s relatively new loan initiative is designed to boost the status of women in the public and economic sectors by enabling them to access better loans, quicker and with fewer strings attached.

Self-reported barriers to having an account at a financial institution - Courtesy of Global Findex database

Self-reported barriers to having an account at a financial institution - Courtesy of Global Findex database

Commenting on the half-day workshop, which saw many fruitful ideas and discussions concerning the promotion of cashless transaction and digitalisation, Walid Labadi, IFC country manager in Egypt, said, “It is important for banks in Egypt to keep up with new technologies to provide easier access to services for their customers, and increase their reach to those currently without a bank account.”

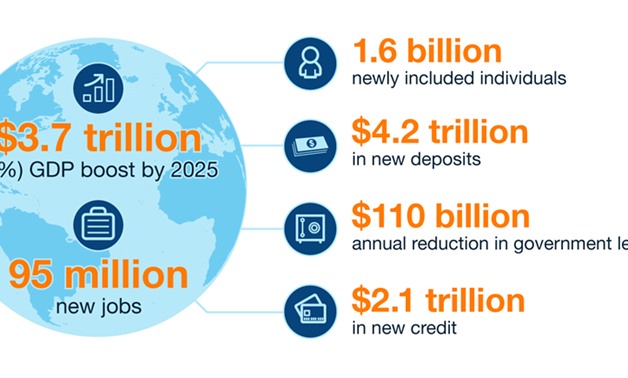

Financial inclusion in Egypt is also expected to lead to better economic development, reduced poverty and an increase in GDP, according to projections based on country income revealed in a September 2016 report by the McKinsey Global Institute (MGI) titled, “Digital finance for all: Powering inclusive growth in emerging economies.”

The MGI report revealed, as did The Global Findex Database, that an astonishing two billion individuals and 200 million micro, small, and midsize businesses in emerging economies lack access to savings and credit banking accounts. It further concluded that those that have access often end up paying high fees for a limited range of products.

Building on this finding, the report projected that by increasing financial inclusion lower-income countries, like Ethiopia and India, have to potential to add

10 to 12 percent to their gross domestic product (GDP) and middle-income counties, like China and Mexico, have the potential to increase the GDP by

four to five percent. Meanwhile, lower middle-income countries, like Pakistan, are expected to achieve a

seven-percent increase in GDP.

A 2017 report published by the Asian Development Bank (ADB), in collaboration with the global management consulting firm Oliver Wyman, and financial inclusion-focused consulting firm MicroSave, titled “Accelerating Financial Inclusion in Southeast Asia with Digital Finance”, also revealed that lower middle-income countries can expect at least a

six-percent increase in GDP.

Applying this to

Egypt, which is considered to be a lower middle-income country, according to the 2018 World Bank Atlas method that defines lower middle-income economies as those with a gross national income (GNI) per capita between $1,006 and $3,955, it becomes clear that Egypt would be able to benefit a substantial increase in GDP of

seven percent. Thus, as Labadi, IFC Country Manager in Egypt, put it, “Financial inclusion is a key enabler to reducing poverty and boosting prosperity.”

Evidence and research has shown that improvements in fin-tech space have been leading to more innovative, and frankly “better” business models, as has been clear in Sub-Saharan Africa and Egypt recently, as several reports have pointed out. This, according to The World Bank, is because the recent improvements have enabled financial services to reach more people at more accessible prices.

Asia and Africa are home to most of the world's unbanked individuals - Courtesy of the Global Findex Database

Asia and Africa are home to most of the world's unbanked individuals - Courtesy of the Global Findex Database

Digitalized financial services are also expected to lead to a decline in unemployment rates, which has been clear in Egypt over the past couple of years. Commenting on the correlation between DFS and declining unemployment rates, Jin-Yong Cai, IFC executive vice president and CEO, said, “The benefits of digital finance extend well beyond conventional financial services: This can also be a powerful tool and an engine for job creation in developing countries.”

Looking at women in particular, DFS is expected to allow women to work more by increasing their mobility status through enabling them to avoid traveling to faraway bank branches, according to a report published by the Global Partnership for Financial Inclusion (GPFI) titled, “Digital Financial Solutions to Advance Women's Economic Participation”. The report revealed that the increased privacy allowed through the digital financial system allows women to have more control over their finances, helping them invest more in the business sector, earn higher returns and improve their labor-force participation.

Persistent gender gaps in account ownership have left women in a weaker financial position - Courtesy of Global Findex Database

Persistent gender gaps in account ownership have left women in a weaker financial position - Courtesy of Global Findex Database

The report further suggested that digitalized financial services mean that governments would be able to view spending habits and so on, enabling them to better secure states against possible terrorist attacks or extremist groups. The digitalization of finances will also mean that tax evasion by companies would be more difficult, as many companies in emerging markets, like Egypt, pay their employees in cash to reduce their taxes.

Thus, it is clear that the move towards digitalized services led by the Central Bank of Egypt (CBE) and the Egyptian Banking Institute (EBI) will lead to a boost in the economy, and a better financial status for women. As Jason Lamb, deputy director of Bill & Melinda Gates Foundation, suggested, digital financial inclusion will bring “financial services to some of the world’s most vulnerable unbanked populations as well as advance knowledge on creating a robust digital payments ecosystem.”

Comments

Leave a Comment