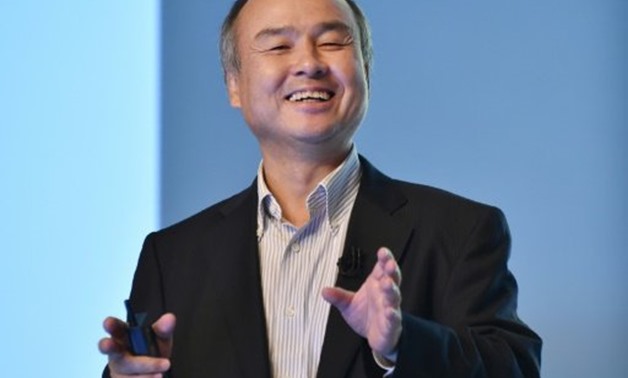

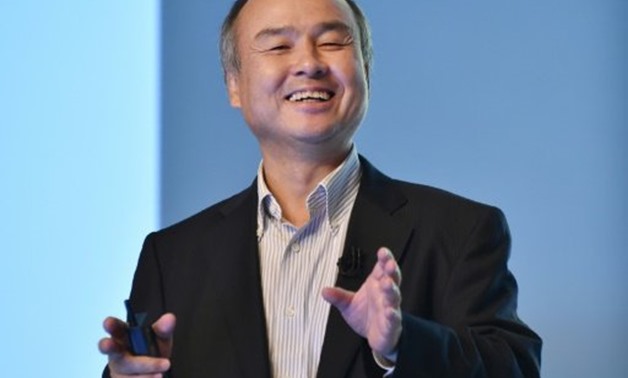

© AFP | Led by flamboyant founder Masayoshi Son, Softbank has embarked on a string of international acquisitions both big and small in recent years, while he was among the first business people to meet Donald Trump after his November election victory.

TOKYO - 7 Aug 2017: SoftBank said Monday its quarterly net profit plunged after booking a big gain from the sale of part of its stake in Chinese e-commerce firm Alibaba a year ago.

The Japanese mobile giant said net profit for the three months to June came in at 5.5 billion yen ($50 million), compared with 254.2 billion yen when it sold off part of its stake in Alibaba.

Operating profit for the April-June period, however, surged 50.1 percent to 479.3 billion yen as it included gains from its SoftBank Vision Fund in the latest figures and as US subsidiary Sprint lifted its profitability.

The Japanese firm is setting up the $100 billion technology investment fund with Saudi Arabia's sovereign wealth fund and other partners.

SoftBank's revenue in the quarter rose 2.8 percent to 2.18 trillion yen, SoftBank said.

The Japanese firm also logged gains from its Yahoo Japan business, but they were offset by sluggish domestic telecom operations and losses at British iPhone chip designer ARM Holdings, which SoftBank bought last year.

The company did not release earnings estimates for the fiscal year through March 2018, which is not unusual for SoftBank.

Led by flamboyant founder Masayoshi Son, Softbank has embarked on a string of international acquisitions both big and small in recent years, while he was among the first business people to meet Donald Trump after his November election victory.

Son pledged to invest $50 billion in business and job-creation in the United States, winning open praise from the then president-elect.

Son also has his eye on a potential merger with T-Mobile US or making an offer for Charter Communications, the second largest cable provider in the US.

© 2017 AFP

Comments

Leave a Comment