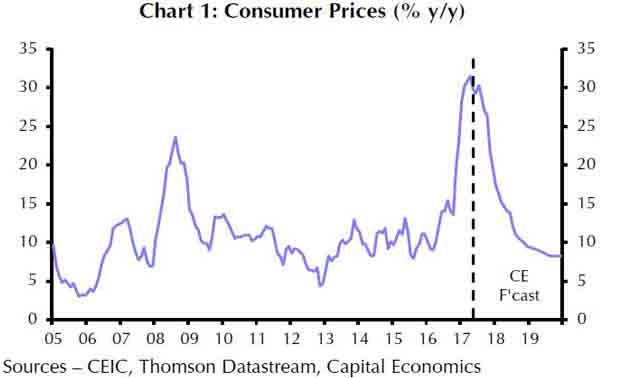

Changes in consumer prices- via Capital Economics.

CAIRO – 8 July 2017: Egypt’s decision to hike interest rates by 200 basis points comes in response to the latest subsidy cuts, which would temporarily push inflation up, London-based macroeconomic research group Capital Economics said in a research note this week.

“The move suggests that the tightening cycle is now over and that the next move in interest rates is likely to be down,” Middle East economist Jason Tuvey said.

The research group said that by this decision, the Central Bank of Egypt (CBE) aimed to tackle the expected rise in inflation as a result of hiking fuel prices by up to 55 percent and the introduction of new electricity tariffs, which saw increases between 18-35 percent.

The CBE unexpectedly decided Thursday to raise interest rates by two percent. The Monetary Policy Committee (MPC) hiked the overnight deposit rate to 18.75 percent from 16.75 percent and the overnight lending rate to 19.75 from 17.75 percent.

Fuel and power price hikes are expected to add 1.5 percent to the headline inflation rate, Tuvey said. “However, over the next six to nine months this is likely to be more than offset by the unwinding of last year’s sharp drop in the pound,” He added.

By the end of 2018, the headline inflation rate is predicted to ease to 13 percent (+/- 3 percent), which Tuvey said will urge the CBE to start cutting interest rates.

Capital Economics forecasts that the overnight deposit rate will fall to 12.75 percent by the end of 2018.

Investment banks and economists expected the CBE to keep interest rates unchanged this month. Capital Economics attributed this to declining inflation from a 30-year high of 31.5 percent in April to 29.7 percent in May.

It also said that the trade deficit started to improve, standing at $3.5 billion in the first quarter of 2017, compared to $5.7 billion in the same period in 2016, in addition to a rising foreign reserves.

Egypt's foreign reserves stood at $31.305 billion at the end of June, edging closer to pre-2011 levels of $36 billion.

The two consecutive increases in base rates this year were not taken into account in the state budget for the 2017/2018 fiscal year, deputy Finance Minister for Treasury, Mohamed Moeet told Reuters Saturday.

"We expect the interest rate decision to be a temporary measure to target inflation," Moeet said. "We expect inflation to fall in early 2018 and thus (can) begin cutting interest rates."

Comments

Leave a Comment