FILE – Governor of the Central Bank of Egypt (CBE) Tarek Amer

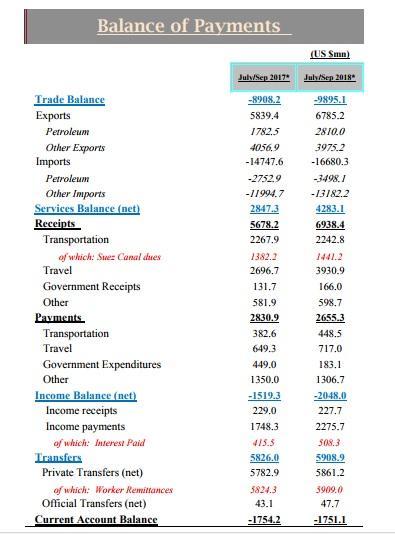

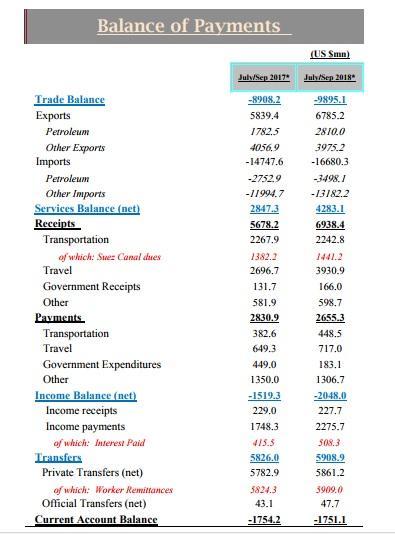

CAIRO – 13 January 2018: Egypt achieved an overall surplus of $284.1 million in its balance of payments (BOP) during July to September of fiscal year 2018/2019, according to the Central Bank of Egypt (CBE).

CBE attributed the surplus to the current account deficit which stabilized at $1.8 billion and the capital and financial account that stood at $1.6 billion.

BOP is the difference in total value between payments into and out of a country over a period.

“The BOP remained steady despite emerging markets turbulence, normalization of developed markets monetary policy and the resulting tightening global conditions,” CBE clarified.

As per the current account data, CBE said that the service balance and workers’ remittances are the key drivers of stability in the current account.

The services surplus surged by 50.4 percent, to $4.3 billion during the three months of 2018/2019, compared to $2.8 billion during the same months of prior fiscal year.

This hike was driven by progress of travel balance surplus which rose to $3.2 billion, compared to $2 billion during the compared period of the previous year, and Suez Canal receipts which hit $1.44 billion, compared to $1.38 billion, with an increase of 4.3 percent.

Moreover, net unrequited current transfers increased to $ 5.9 billion, compared to $5.8 billion in the months of 2017/2018, supported mainly by the increase in workers’ remittances.

The data also revealed the trade deficit rose by $1 billion, to $9.9 billion, primarily due to the increase in merchandise imports by $ 1.9 billion and a $945.8 million increase in merchandise exports.

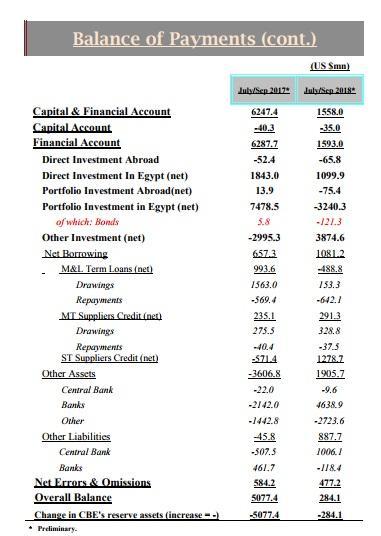

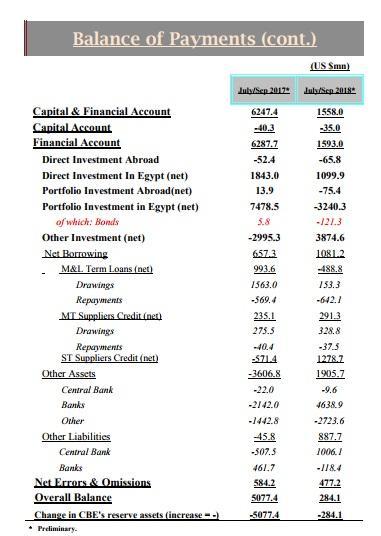

Regarding capital and financial account, CBE assigned the net inflow of $1.6 billion to the hike of foreign direct investments (FDI), portfolio investment in the state, and loans and facilities.

FDI in Egypt achieved a net inflows of $1.1 billion during the July-September period as a result of the net inflows of $ 478.8 million for oil sector investments, and $ 237.4 million for real estate investments, after it recorded total inflows of $2.9 billion, while total outflows posted $ 1.8 billion.

Portfolio investment in Egypt reached a net outflow of $3.2 billion, compared to a net inflow of $7.5 billion, due to the decrease in foreigners' investments in Egyptian TBs.

It also noted that disbursements of medium- and long-term loans and facilities dropped to $482.1 million, down from $ 1.8 billion, while total repayments increased to $ 679.6 million, from $ 609.8 million, resulting in a net repayment of $197.5 million, compared to a net disbursement of $ 1.2 billion.

Comments

Leave a Comment