The logo of Pharos Holding for Financial Investments is seen during an interview with Reuters in Cairo, Egypt September 6, 2017 - Reuters/Ehab Farouk

CAIRO – 10 January 2019: Pharos Holding expected Egypt to achieve a pickup in economic activity over the next five years on more sustainable dynamics as remittances improve, tourism recovers, oil and gas production rises, and foreign direct investments (FDI) increase.

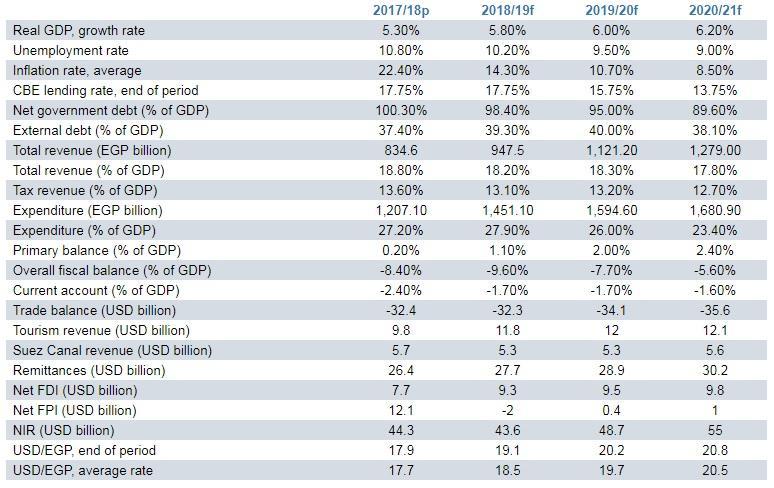

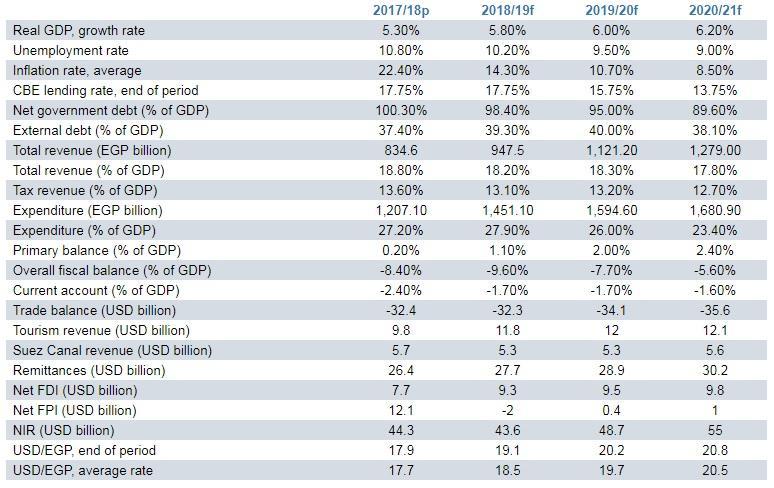

In a research entitled “Egypt on Road to Recovery”, Pharos expected the inflation to decline gradually to hit 14.3 percent in fiscal year 2018/2018 and 10.7 percent in fiscal year 2019/2010 on a year on year basis.

The Central Agency for Public Mobilization and Statistics (CAPMAS) previously announced that the annual inflation rate hit 15.6 percent in November 2018, compared to 26.7 percent in the same month of 2017.

On a monthly basis, the rate decreased 0.7 percent, compared to October.

Generally, Egypt targets an inflation rate of 13 percent in its fiscal year 2018/2019 budget.

CAIRO - 10 December 2018: Egypt's annual consumer price inflation slipped to 15.6 percent in November 2018, compared to 26.7 percent in the same month of 2017 that rose due to the flotation of the Egyptian currency, state-statistics body said Wednesday, Oct. 10.

“We expect the CBE to keep its overnight lending interest rate at 17.75 percent in 2H FY2018/19. However, as the global monetary policy normalizes, we expect the CBE to gradually bring down its overnight lending interest rate to 15.75 percent in FY2019/20 and 13.75 percent in FY2020/21,” pharos stated in its research.

The Monetary Policy Committee of the Central Bank of Egypt (CBE) kept the overnight deposit rate and the overnight lending rate at 16.75 percent and 17.75 percent, respectively, during December’s meeting for the sixth time in 2018.

CAIRO - 27 December 2018: The Monetary Policy Committee of the Central Bank of Egypt (CBE) kept the overnight deposit rate and the overnight lending rate at 16.75 percent and 17.75 percent, respectively, during December's meeting for the sixth time this year.

As per the current account deficit, pharos anticipated it to decrease from 2.4 percent of GDP in FY2017/18 to 1.7 percent of GDP in FY2018/19 as a result of declining petroleum trade deficit, higher tourism revenue, and higher remittances.

CBE announced previously that Egypt’s current account deficit for FY2017/18 that ended in June narrowed by 58.6 percent to $6 billion.

CAIRO - 2 October 2018: Egypt's current account deficit for the 2017-18 financial year that ended in June narrowed by 58.6 percent to $6 billion, the central bank said on Monday. The central bank attributed the drop in the deficit to the impact of currency liberalisation.

Also, the research read,” We project the foreign direct investments to increase from $7.7 billion in FY2017/18 to $9.3 billion in FY2018/19 and to $9.5 billion in FY2019/20. On the other hand, the net international reserve (NIR) level should stabilize around the current levels of $44 billion in FY2018/19.”

“We expect NIR to improve further over our forecast horizon, mainly on tourism recovery, steady remittances and solid FDIs in oil and gas sector,” it added.

FDI recorded $7.7 billion in 2017/2018,$4.5 billion of which were in the oil sector. FDI declined during last year compared to $7.9 billion in 2016/17.

According to Pharos, the primary fiscal balance is expected to improve from a surplus of 0.2 percent of GDP in FY2017/18 to a surplus of 1.1 percent of GDP in FY2018/19 and 2 percent of GDP in FY2019/20.

It also forecasted that the overall budget deficit would decline from 9.6 percent of GDP in FY2018/19 to 7.7 percent of GDP in FY2019/20.

CBE said in the beginning of December2018 that the total expenditure hit 1.229 trillion in 2017/18, bringing the total deficit to LE 432 billion, or 9.8 percent of Egypt's gross domestic product (GDP).

CAIRO - 2 October 2018: Egypt's current account deficit for the 2017-18 financial year that ended in June narrowed by 58.6 percent to $6 billion, the central bank said on Monday. The central bank attributed the drop in the deficit to the impact of currency liberalisation.

“The government’s net debt is projected to decline from 100.3 percent of GDP in FY2017/18 to 89.6 percent of GDP in FY2020/21 on higher GDP growth, fiscal consolidation and improved debt dynamics on currency and tenor,” according to the research.

Comments

Leave a Comment