PMI - Emirated NBD report

CAIRO – 4 April 2017: Business activity for Egypt’s non-oil private sector deteriorated for the 18th consecutive month in March, due to sharper drops in output and new orders, a survey conducted by Emirates NBD Egypt found.

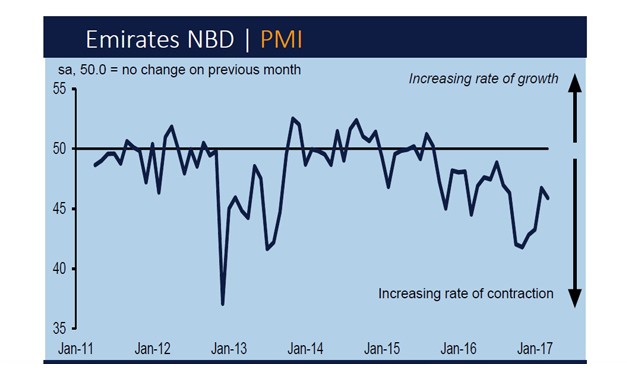

The Emirates NBD PMI headline index edged down from February’s six-month high of 46.7 to 45.9 in March, a sign of worsening business conditions. The result extended an 18-month squeeze, since readings below 50 mark a deteriorating business, according to the survey.

The survey credited the headline index’s slip to “steeper declines in output and new work.”

“The March PMI highlights ongoing weakness in Egypt's private sector,” said Head of Research and Chief Economist at Emirates NBD Tim Fox.

“Although the economy's rebalancing process is proceeding as one would expect - evident through a narrowing in the trade deficit and higher FX reserves - it will take some time before this translates into stronger growth momentum. One silver lining from the report is that inflationary pressures are continuing to ease,” Fox added.

Senior Emerging Markets Economist at London-based Capital Economics William Jackson said, “Egypt’s PMI painted a downbeat picture… Nonetheless, today’s data highlights that Egypt’s economy is extremely weak and that the recovery over the coming quarters will be fitful.”

“One positive point to take away from today’s data is that the new export orders component remained strong. That suggests that the fall in the pound and improvement in external competitiveness may already be filtering through to the real economy,” Jackson added in an emailed regional report.

Facing increasing and chronic economic troubles, Egypt's authorities launched an ambitious reform program in November to reinstate macroeconomic stability and promote inclusive growth to revive an economy hit by political instability and regional security concerns since 2011.

The authorities succeeded in sealing a $12 billion deal with the International Monetary Fund to support is ambitious economic reform plan after applying a set of painful reforms including free-floating the Egyptian pound, introducing a value added tax and slashing fuel subsidies.

Comments

Leave a Comment