Commercial Bank's foreign liabilities graph - Reuters

CAIRO – 14 June 2017: Although the impact of Qatar diplomatic spat has raised quests about the country’s imports, London-based Capital Economics latest report was more concerned about the banking sector.

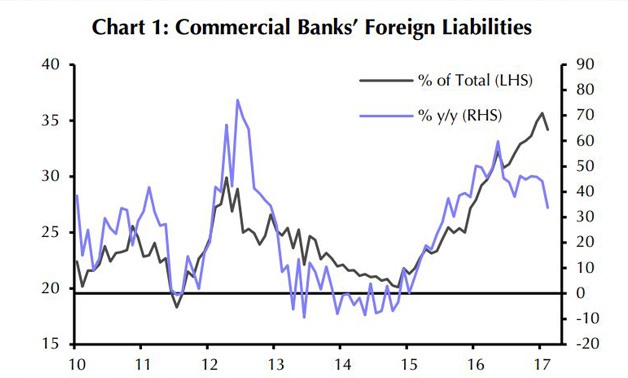

“Investors in Doha should be vigilant to the effect of the rift on the banking sector,” Capital Economics said, expecting external financing conditions to deteriorate.

On reports that some GCC countries ordered their banks to halt transactions with Qatari banks, the report said: “If Qatari banks struggle to rollover their external debts, they could be forced to shrink their balance sheets and tighten credit conditions,” said Jason Tuvey Middle East economist.

With regards to credit growth, Tuvey said that it forecasted to be weak on rising banking borrowing costs.

Qatar is unlikely to devaluate its riyal on strong foreign reserves, balance sheets, Tuvey said in a separate report Sunday.

Comments

Leave a Comment