CAIRO - 31 January 2019: Global and local economic incidents shadowed the Egyptian Exchange (EGX) during 2018, as it witnessed a downtrend since April after hitting its highest historical level of approximately 18,400 points.

Through the year, the benchmark EGX30 dropped 13.21 percent, or 1,983.37, to end the year at 13,035.77 points compared to 15,019.14 at the end of 2017. The value of trading on the EGX30 recorded LE 188 billion through 43 billion shares.

In 2017, the EGX30 rose by 21.66 percent or 2,674.25 points, reaching 15,019 points.

The small and mid-cap index EGX70 slumped during the year by 16.16 percent, or 133.8 points, reaching 693.83 points, compared to 827.66 points by the end of last year, and the broader index EGX100 also lessened during January-to-December 2018 period by 12.4 percent, or 244.55 points, to close at 1,727.21 points, down from 1971.76 at the end of the prior year.

Analysts told Egypt Today that this downtrend came due to several economic decisions and actions which took place in Egypt and globally; the decline in the value of the local currency, the delay of IPOs planned for government institutions, the trade war between the United States U.S and China, and the crisis of Emerging Markets (EM).

Analyst in Institutional Equity Sales at NAEEM Holding for Investment Mohamed Sameh attributes the downtrend of the Egyptian Exchange (EGX) in 2018 to several reasons, including expectations that the Federal Reserve will raise the interest rates several times during 2019 and thereby further pressure the highly indebted emerging markets. Their debt service cost in such economies is expected to rise as advanced economies normalize monetary policy.

Sameh added that this action coincided with the trade war between U.S. and China, which is the biggest in the Emerging Market, clarifying that this war caused a flop in the Chinese market and became one of the reasons behind the out- flows from all emerging markets.

Escalating trade protectionism, heightened geopolitical tensions and the uptick in oil prices at that time built fears concerning achieving the target path for the budget deficit and headline inflation rate, which was announced at 13 percent (±3 percent), he notes.

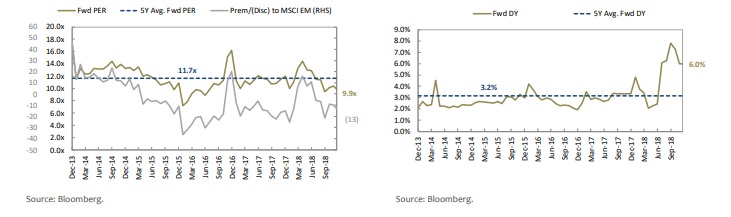

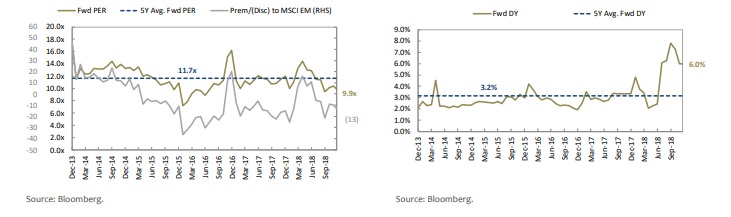

SHUAA Securities Egypt attributed the ups and downs of EGX in 2018 to three main forces.These forces are analysts’ earnings estimates as measured by forward earnings-per-share (EPS) for the index components, re-rating/de-rating as measured by a higher/lower forward price-to-earnings (P/E) ratio which is also partially affected by earnings estimates, and dividend yield (DY).

Associate Vice President of Equity Research at Beltone Financial Ali Afifi explains that the EGX witnessed an overrated hike after the flotation, which was followed by an overrated decline witnessed in 2018. Afifi added that the increase of interest rates in surrounding countries caused investor outflows from the Egyptian market.

In November 2016, Egypt floated its currency, losing around 50 percent of its value as part of the economic reform program imposing taxes and cutting energy subsidies. These moves aimed to trim the budget deficit after the Executive Board of the International Monetary Fund (IMF) approved a $12 billion loan as financial assistance to support the Egyptian economic reform program.

Emerging markets were affected by an exit wave of foreign investments in government debt instruments during the second quarter of 2018 as the US dollar rose in value, raising fears in comparable emerging markets, particularly the more turbulent Turkey and Argentina.

In Argentina, the currency was devalued by 70 percent with 60 percent interest rates, turning the country into an attractive investment destination, and the Turkish lira lost more than 40 percent of its value since the beginning of 2018.

Foreign investments in Egyptian treasury bills (T-bills) recorded LE 210.21 billion ($11.71 billion) at the end of October, compared to LE 234.52 billion ($13.06 billion) by the end of September. The Central Bank of Egypt (CBE) revealed that foreign investments in T-bills in local currency declined for the seventh month in a row, losing around $1.4 billion in October, as it reached its lowest levels since June 2017.

As a result of the crisis hitting emerging markets, the outflows of foreign investments in T- bills reached around $9.8 billion during April to October 2018, as the investments hit LE 380.3 billion ($21.5 billion) in March.

“Investors seek appropriate return for their risk appetite,” Sameh stated, explaining that turmoil surrounding some emerging markets pushed the investor to assign a higher risk premium to emerging markets to compensate growing risk.

Egypt targets average interest rates on the government’s debt instrument reaching 14.7 percent in the current budget, compared to an expected average of 18.5 percent in FY2017/18 budget.

During its December meeting, the CBE’s Monetary Policy Committee kept interest rates on hold for the sixth time in 2018, setting the overnight deposit rate and the overnight lending rate at 16.75 percent and 17.75 percent, respectively.

IPOs

The EGX witnessed four initial offerings during the recently ending year amounting to LE 5.2 billion, marking an increase of 25 percent, compared to 2017. The private offerings of these hit LE 4.68 billion, compared to LE 3.39 billion in previous year. Moreover, public offerings recorded LE 0.53 billion in 2018, compared to LE 0.57 billion in 2017.

Meanwhile, Egypt delayed the listing shares of state-owned companies on the Egyptian Exchange, such as the 4.5 percent stake of Eastern Company slated for October. The government attributed the delay to volatility in the global market, noting that if the shares were floated, it would have failed to be covered at proper valuation.

Analysts agree that this delay contributed to the drop EGX witnessed. The delay in offering the program’s scheduled shares was also reportedly one of the reasons behind the decline of EGX.

Associate Vice President of Equity Research at Beltone Financial Afifi says the effect of the IPOs’ delay was not big because share prices had already downed. He also stated that the percent- age of the free float is not enough.

Sameh argues that the perfect timing for the offering was missed, stating that the price of Eastern Company fell to around LE 15 from LE 25, while the government plans to offer it at LE 21; as a listed company, its pricing is easily affected.

“The IPO program is an opportunity for investors waiting for this opportunity,” Analyst-Institutional Equity Sales at NAEEM Holding for Investment," Sameh says.

In 2016, Egypt announced the launch of the government’s IPO program offering shares over three to five years in several state-owned companies in fields such as petroleum, services, chemicals and real estate. As a part of the economic re- form program, the government targets offering 15-30 percent of stakes in state-owned companies on the stock exchange (EGX) to increase funding to Egyptian companies, maximize the benefit from state assets, and attract local and foreign capital flows to Egypt.

Market Capitalization

Market Capitalization of the EGX lost LE 75.2 billion during 2018, recording LE 749.7 billion by the end of the year compared to LE 824.91 billion in the beginning of 2018.

Sameh said that increasing market capitalization through IPOs will encourage investors to invest in the market and will expand the investor database, explaining that market capitalization comprises between 16 percent to 18 percent of the gross domestic product (GDP), representing one of the lowest rates globally and in emerging markets,noting that it should be nearer to 40 percent. According to Sameh, increasing market capitalization will help market liquidity and trading volumes, which will encourage them to easily enter market as liquidity and market depth is a critical point for foreigner flows. “Foreign funds would like to use the mini-ticket technique to get in and out of the market without any troubles,” he says.

The trading volume throughout the year reached 60.8 million shares, trading through 6.3 billion transactions, with a turnover of LE 358.5 billion.

Arab and Foreign Investors

Foreign Investors were net buyers during 2018 at LE 5.78 billion, compared to LE 9.55 billion in the prior year, according to annual data from the EGX. Meanwhile, quarterly data revealed that Arab investors have been net sellers at LE 838.41 million since the beginning of the year, while non-Arab foreign investors have been net buyers at LE 7.218 billion.

While low oil prices are good for the state budget, according to Sameh, the EGX will have an inverse effect as trading of Arab investors and organizations are affected by these prices. He clarified that declining oil prices would push Arabs to sell off in other markets and invest in theirs.

“Foreign investors once acquire an annual share amounting 20-35 percent of the total traded value in the EGX, this lasted from 2007 through to December 11, 2018. The decline of this segment has already affected the performance of the EGX and inevitably will still have an important impact on the performance of the EGX in the upcoming period,” an article on Mubasher Trade argues.

Expectations of 2019

In 2019, Sameh expected EGX to witness a horizontal trend, in contrast with the previous downtrend, until the successful offering of the IPOs that would increase market capitalization and encourage investors to invest on the EGX.

The expectation that the US will tighten monetary policy this year cast doubt that the CBE can continue easing monetary policy cycle, he added.

Mubasher Trade also anticipated that tightening monetary policy in the US and the expected tightening of monetary policy in the Euro area starting 2019 should have a negative impact on the emerging markets, particularly those with high external debt. “But any severe correction in the equity markets of developed economies may suspend current movements of tightening monetary policy.”

“However, it is possible for the Egyptian equity market to have positive performance in the years ahead (strengthened by the forecasted high GDP growth rate and the forecasted lower interest rate) despite any crash or correction movements that may hit equity markets in advanced economies within the upcoming period, particularly the in US stock market. Also, sometimes any correction movement in advanced economies’ equity markets may encourage investors to inject their money in emerging countries particularly those with a high GDP growth rate and very cheap equities compared to peers,” Mubasher further notes.

Sameh also feels that oil prices are expected to slump for some time as a result of easing global growth, especially in emerging markets amid the surge in the US treasury yield.

He argues that the market is more aligned with the global trend, stating that bearish markets are positively correlated with each other more so than in the bullish market.

On another note, Afifi forecasts the EGX witnessing an improvement through 2019 as it executes the state IPOs program.

Egypt’s self-sufficiency in natural gas reflects positively on the oil and gas sector, Afifi notes, arguing that these positive results will reach the industrial sector as most factories and plants depend on gas.

Egypt achieved self-sufficiency in gas at the end of September 2018 after adding 1.6 million cubic feet to its production from the latest gas discoveries, including West Delta’s Taurus and Libra fields, as well as the Atoll and Zohr gas fields.

Comments

Leave a Comment